Below is a comprehensive guide to computing overtime pay for employers and employees in the Philippines.

Many employees worked extra hours at least once a week. While this can increase productivity, not compensating employees for these additional hours violates crucial Philippine labor laws.

According to the ADP Research Institute, unpaid overtime went from an average of 7.3 hours per week in 2020 to 9.2 hours per week by 2021. This trend is alarming in a country such as the Philippines, where employee protection and fair compensation are major targets.

When it comes to calculating overtime pay in the Philippines, HR professionals and business owners might find it difficult especially if they are unfamiliar with labor laws. Manual approaches can be time consuming and prone to mistakes.

This blog describes how to compute overtime pay in the Philippines, guiding you through the process and ensuring your compliance with labor laws.

What is overtime pay in the Philippines?

Overtime pay is the compensation employers pay for any work beyond eight (8) hours a day or over 40 hours a week. However, work may be performed beyond the required hours. Nevertheless, employees who render more than 40 hours of work a week are entitled to a premium pay rate for the extra work.

Under Philippine labor laws, overtime work is one of the workers’ statutory monetary benefits. In other words, employers are required to pay an additional compensation of at least twenty-five percent (25%). Moreover, they will need to pay the regular hourly rate for work performed beyond eight hours a day or their regular working hours.

This compensation is intended to protect employees from exploitation and provide equitable pay. HR departments and employers should promote transparency in their workplace culture. The purpose of overtime pay is to safeguard employees from exploitation and guarantee that they are fairly compensated for their work. Understanding how to calculate overtime pay rates effectively is essential for preventing mistakes.

What is the overtime pay rate in the Philippines in 2024?

Employers who require workers to render work beyond the regular hours are required to pay overtime rates. The premium overtime pay rates in the Philippines may vary. Furthermore, it depends on whether it is an ordinary working day, a regular holiday or rest day, or a special day.

So, how much is overtime work in the Philippines? Below is a summary of the formulas to calculate overtime pay. These include the overtime hourly rate for different types of days where an employee renders overtime work:

- Ordinary working days: Plus 25% on the regular hourly rate or 125% of the hourly rate.

- Scheduled rest day or special day: Plus 30% on a special day or rest day hourly rate or 130% x 130% of the hourly rate

- A special day falling on a scheduled rest day: Plus 30% on the special day rate that falls on a scheduled rest day or 150% x 130% of the hourly rate.

- Regular holiday: Plus 30% on the regular holiday hourly rate or 200% x 130% of the hourly rate

- A regular holiday falling on a rest day overtime: Plus 30% on the hourly rate or 260% x 130% of the hourly rate

- Night shift overtime pay: Night shift overtime rates vary, and they could range from 137.5% to 557.7 of the basic daily wage.

Related: Minimum Wage Rules

How to compute overtime pay? (Philippines)

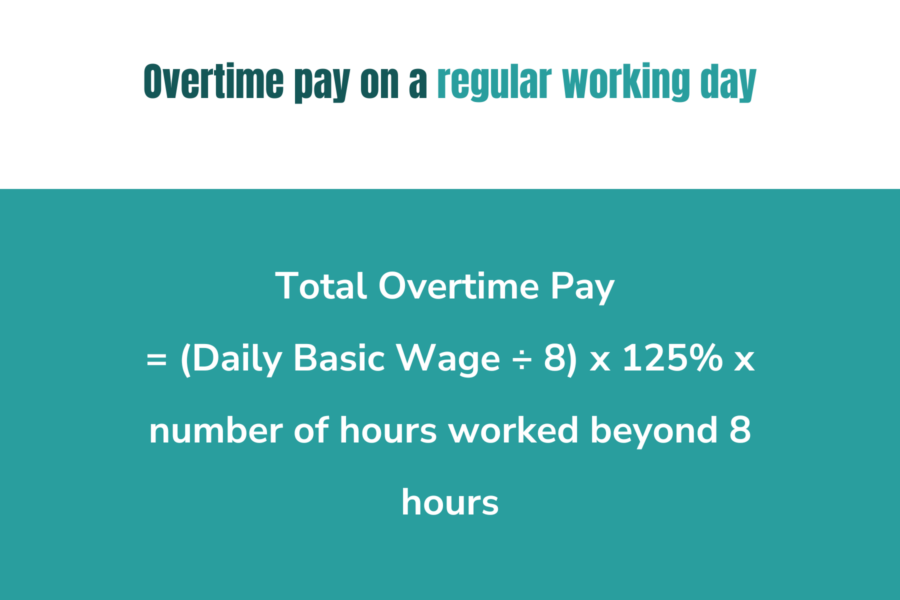

Ordinary working days OT computation

Suppose the employee worked overtime on ordinary days that are not a holiday or rest days. In that case, every work beyond the eight (8) hours required on ordinary working days gets an extra 25% of the hourly rate.

To compute the hourly rate, divide the basic daily wage by eight (8).

As a result, the formula for calculating the hourly overtime pay on an ordinary working day is as follows:

Overtime Pay = (Daily Basic Wage ÷ 8) x 25%

To calculate an employee’s total overtime pay in a day, the following formula applies:

Total Overtime Pay = (Daily Basic Wage ÷ 8) x 125% x number of hours worked beyond 8 hours

Scheduled rest day or special holiday OT computation

Suppose an employee comes in to render work on a scheduled rest day. In this case, any extra work performed beyond eight (8) hours gets an additional compensation equivalent to 30% of the rest day pay shall be applied.

As a result, the special day or rest day overtime rate follows the formula below:

Total Overtime Pay = (Daily Basic Wage ÷ 8) x 130% x 130% x number of hours worked beyond 8 hours

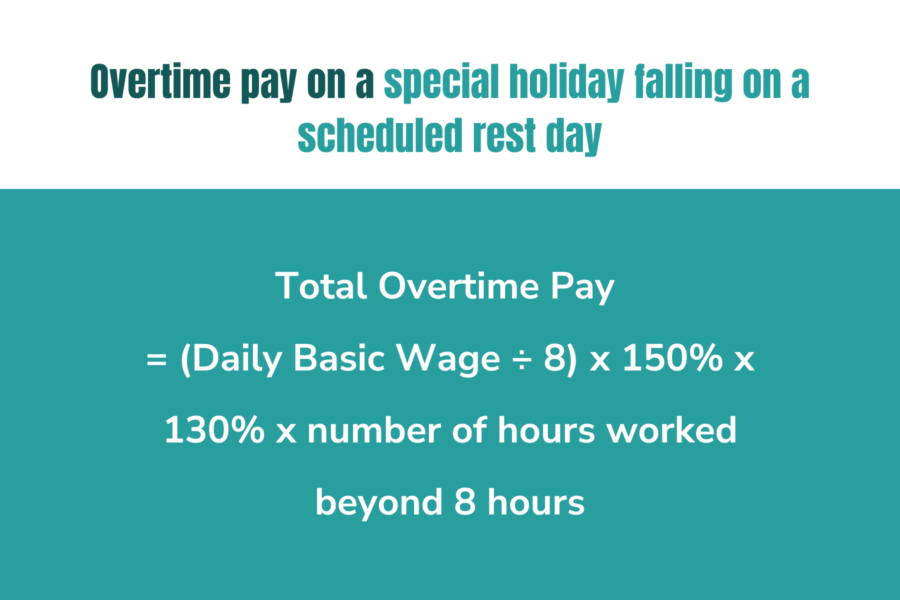

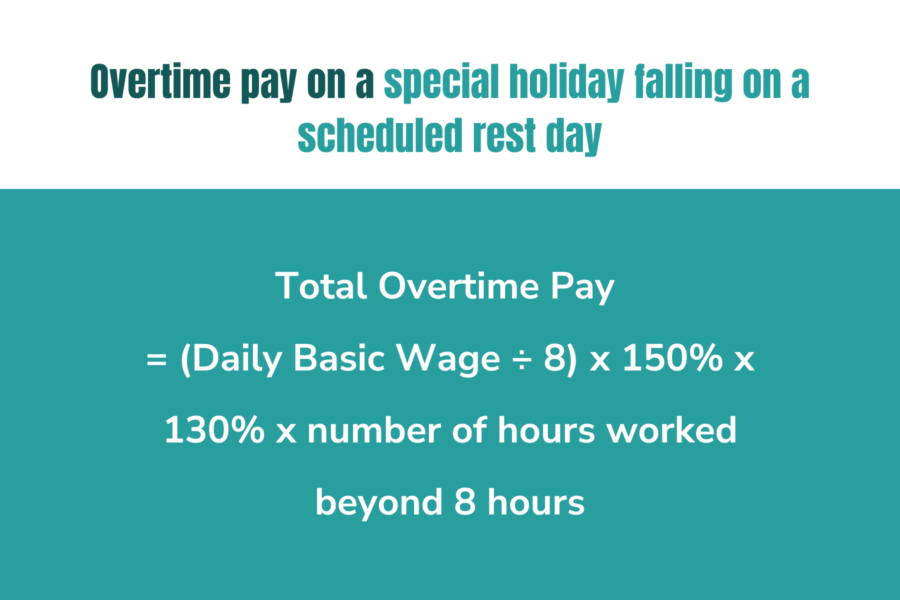

A special holiday falling on a scheduled rest day OT computation

In cases where a worker comes to work on a day that is both a special holiday and a scheduled rest day, the following overtime hourly rate shall apply:

Total Overtime Pay = (Daily Basic Wage ÷ 8) x 150% x 130% x number of hours worked beyond 8 hours

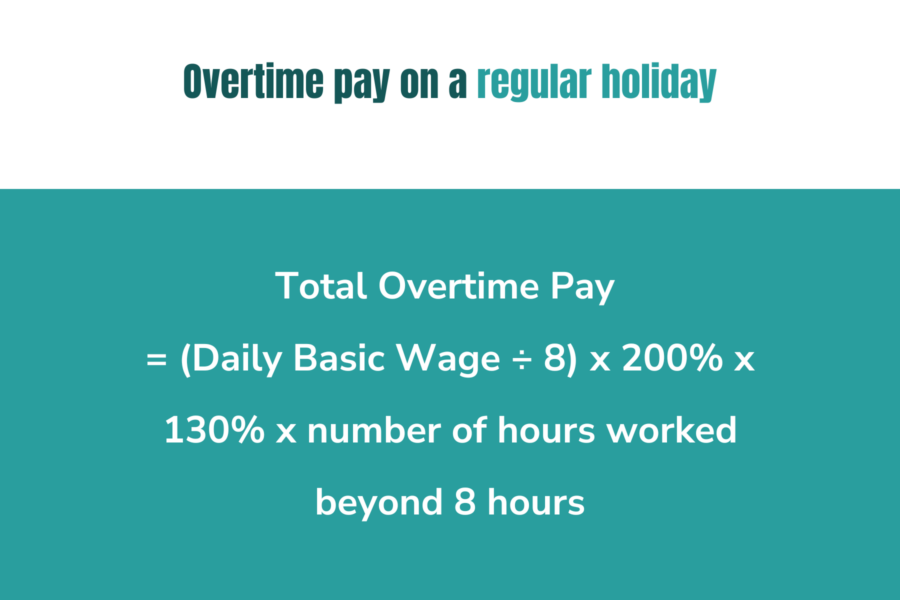

Regular holiday OT computation

When an employee comes in to render work hours on a holiday, they are entitled to their 200% holiday wage plus at least thirty percent (30%) thereof.

Total Overtime Pay = (Daily Basic Wage ÷ 8) x 200% x 130% x number of hours worked beyond 8 hours

A regular holiday falling on a rest day OT computation

Suppose an employee comes to work during a special holiday which is also a rest day. In that case, they are entitled to overtime pay computed as follows:

Total Overtime Pay = (Daily Basic Wage ÷ 8) x 260% x 130% x hours worked beyond 8 hours

Night shift OT pay rates

Workers on the night shift are also entitled to overtime pay of at least 25% plus the regular night shift employee’s hourly rate. To compute overtime pay for hours worked beyond eight hours for employees on the night shift, below is a list of overtime pay computation Philippines.

Ordinary day rate for night shift computation

For ordinary working days, the overtime rate is the hourly rate (110% of the basic daily wage) plus at least twenty-five percent (25%) thereof. To compute the exact amount that shall be paid for overtime hours on an ordinary day, the following formula applies:

Total Overtime Pay = hourly rate x 125% x 110% x hours worked beyond 8 hours

Rest day rate for night shift OT computation

Rest day overtime rate shall be paid a minimum of plus 30%, again multiplied by 30% of the overtime hourly rate. In the formula, the night shift employee’s pay is as follows:

Total Overtime Pay = hourly rate x 130% x 110% x 130% x hours worked beyond 8 hours

Special holiday and a rest day rate for night shift OT computation

Work rendered on a special non-working holiday and a rest day shall be paid an additional 50% of the hourly rate multiplied by an additional 30%. In summary, the formula to get the amount paid for the overtime is as follows:

Total Overtime Pay = hourly rate x 150% x 110% x 130% x hours worked beyond 8 hours

Regular holiday rate for night shift OT computation

The pay for overtime work during a holiday on the night shift is 200% of the basic daily wage like day shifts. However, there is a plus 10% on the rate, multiplied by 130%. To compute the total overtime pay, the formula is as follows:

Total Overtime Pay = hourly rate x 200% x 110% x 130% x hours worked beyond 8 hours

Regular holiday and a rest day rate for night shift OT computation

For night shift overtime during regular holidays, the rate is 260% multiplied by 130% applied to the usual 110% pay for overtime work.

Total Overtime Pay = hourly rate x 260% x 110% x130% x hours worked beyond 8 hours

Double holiday rate for night shift OT computation

An employee working on a double holiday night shift is entitled to 300% of their regular 110% multiplied by 130%. As such, the formula for this is as follows:

Total Overtime Pay = hourly rate x 300% x 110% x130% x number of hours worked beyond 8 hours

Double holiday and a rest day rate for night shift OT computation

Lastly, an employee on a night shift working hours rendering a double holiday, which is also a rest day shall be paid 390% of their hourly 110% rate multiplied by 130%.

Total Overtime Pay = hourly rate x 390% x 110% x 130% x number of hours worked beyond 8 hours

For example, a worker earning a minimum wage of Php 537.00 will have the following overtime pay rates for two (2) extra working hours on different days.

| Overtime Day | Basic Pay | Overtime Pay | Usual Pay | Overtime Pay Amount |

|---|---|---|---|---|

| Ordinary working days | Php 537.00 | 125% | 100% | Php 167.81 |

| Scheduled rest day or special day | Php 537.00 | 130% | 130% | Php 226.88 |

| Rest day and special | Php 537.00 | 130% | 150% | Php 261.79 |

| Regular holiday | Php 537.00 | 130% | 200% | Php 349.05 |

| A regular holiday that falls on a rest day | Php 537.00 | 130% | 260% | Php 453.77 |

Is overtime work compulsory in the Philippines?

No. In fact, under the Labor Code, no employee shall be mandated to work beyond eight hours a day as a general rule. However, there are exemptions when employees might need to continue working beyond the first eight hours. Provided, of course, that they fall under the following circumstances:

- When the country is at war or when there is a national or local emergency

- In cases where overtime work is necessary for the following

- To prevent loss of life or property

- In cases where there is imminent danger to public safety due to accidents or calamities

- When urgent work is needed for machines, installations, or equipment to avoid causing loss or damage to the employer

- During times when a worker needs to put in extra hours to prevent serious loss or damage to perishable goods

- When work is needed to prevent grave obstruction or prejudice to the business

- When overtime is necessary to take advantage of good weather where the quality of work is dependent

Who is entitled to overtime pay in the Philippines?

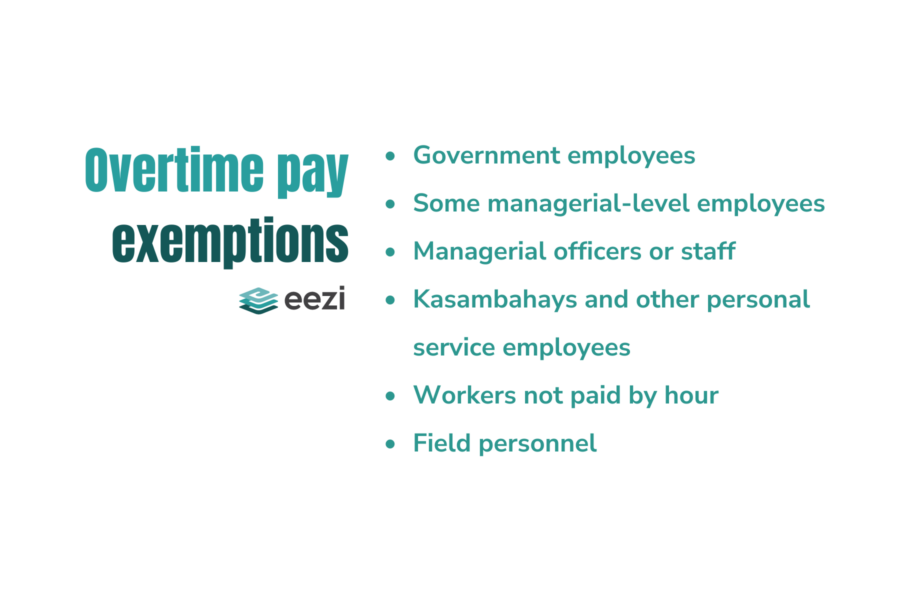

The overtime pay rule applies to all employees in the Philippines. However, there are instances where employees are exempt from receiving overtime pay.

Who is exempt from receiving overtime pay?

The people exempt are the following:

- Government employees in the National Government or its subdivisions, including government-owned and controlled organizations (GOCCs)

- Managerial-level employees who meet certain conditions

- Officers or managerial staff members

- Kasambahays and employees in the personal service of another

- Workers who are paid by results, other non-time work, or where rates are fixed by the Secretary of Labor and Employment

- Field personnel whose jobs are away from the office or place of business

What is not included in the overtime pay computation?

Only the basic wage is used in the overtime pay computation Philippines. Furthermore, the employee’s hourly rate is equivalent to his regular wage divided by eight. However, note that this excludes the Cost of Living Allowance (COLA). Thus, the applicable amount is the basic wage before deductions, minus allowances and other bonuses.

Related:

An easier way of computing overtime pay

Calculate hundreds of overtime pay in a few clicks with eezi‘s timekeeping and payroll software. See how our system works its magic on your HR processes.