What is EPRS PhilHealth, and how to set it up to simplify your PhilHealth payments for more timely and accurate compliance?

Electronic Premium Remittance System (EPRS) for PhilHealth

The Electronic Premium Remittance System or EPRS, is a web application that allows employers to manage members of the Philippine Health Insurance Corporation or Philhealth. This system helps employers monitor and manage payments for their employees who are members of PhilHealth. With EPRS, it is now easier to check statuses, post payments, and monitor transactions.

EPRS is part of Philhealth’s efforts to make the remittance process hassle-free. Furthermore, this is also an effort to promote the efficient delivery of government services and expedite government department transactions. It makes use of automated technology that allows these transactions to go online.

Related:

- List of Government-Mandated Benefits for Employees in the Philippines

- How to Request a PhilHealth Certificate of Contribution

How to set up your EPRS?

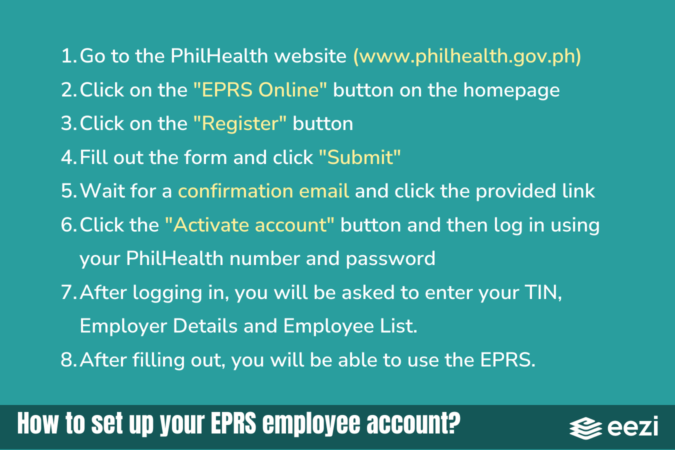

Registering for an account

You will need to register for an account before you can access the EPRS. To register, the employer or their authorized representative must proceed to a PhilHealth office.

Alternatively, employers can register by visiting the PhilHealth Online Portal. On the website, click the link for ePOAF under EPRS. This link will direct you to a form that needs to be filled out. Once accomplished, you will receive an email at the address provided in the form. The email will then give instructions for the next steps of registration.

Logging into your account

The login page of EPRS needs two vital pieces of information to allow access:

- PEN or Philhealth Employer Number

- Password

Managing an employer profile

Once you have access to the EPRS, a page will open displaying the employer’s profile. This is also the homepage. On this page, you can manage your EPRS profile.

Viewing employer profile

The employer’s profile displays all the information about your organization. This includes the name, employer’s PEN, employer type and subtype, business name, and TIN.

However, the employer’s profile does not allow any changes to the information displayed. Furthermore, should the employer wish to change any of the information in their profile, they may request it in a PhilHealth branch.

Changing password

If you wish to change your account password, you may do so by clicking on the User Settings or Gear button found in the upper right corner. It allows you to change the password for the account, which has a maximum of 12 characters with no special characters used.

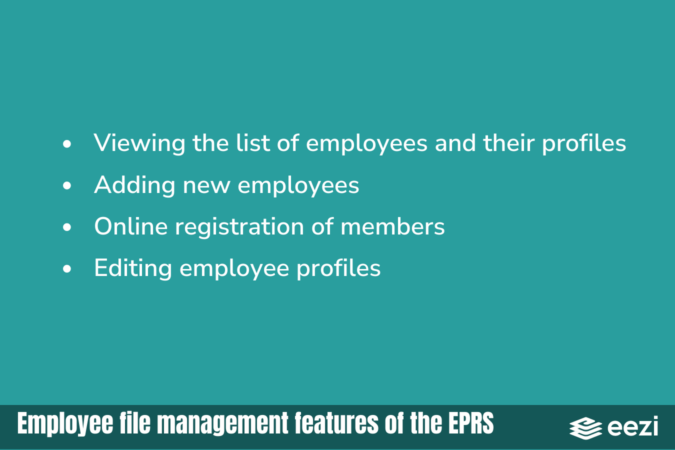

Managing employees

The EPRS allows employers to manage employee data and complete transactions online. To manage employees, you must proceed to the tab labeled “Employees Management.”

Viewing the list of employees and their profiles

Under the Employees Management tab, you will see the list of employees. To view the complete employee profile, you need to click the view icon on the right side of the employee’s name. This will display relevant information about the employee, like full name, PIN or Philhealth Identification Number, employee number, employment date, mobile number, and TIN.

Adding new employees

You may also add new employees under your employer account through EPRS. However, it is only possible if the employee already has an account with the PhilHealth Electronic Registration System or PERS. When adding, you should fill in the employee’s birthdate and PIN. If found, you will see the employee’s information on display. The addition will be completed once the user accepts the employee.

Online registration

Online registration allows the hassle-free registration of new members. If the employee you want to add does not have an existing account with PERS, you can register the employee online through the member’s portal by providing the necessary information.

Editing employee profiles

To edit an employee’s information, click on the pencil icon to the right of the employee’s name. Then, fill out the fields of the form where you wish to make changes.

Monitoring remittance status

The Employees Remittance Status tab in the EPRS displays the list of employees and their remittance status. This status can either be active, no earnings, or separated. Moreover, this tab offers filters that pull up results in mere seconds.

Posting payments

The EPRS digital payment system is connected to online payment channels that accommodate remittances posted by employers. Government departments and private enterprises, even micro and small businesses, benefit from this digital payment system that helps speed up transactions for many users.

The partnership between PhilHealth and MyEG Philippines opens more online payment channels for micro and small businesses. These platforms enable small business owners to make their online payments through online payment channels, like GCash, Maya, and credit or debit cards.

Related: HR Needs for Your Small Business

Monitoring transactions

The Transaction Monitoring tab displays your monthly transaction history. It also shows the total number of transactions and records, along with the details of each transaction made through online payment options.

Remit Premium Contributions with eezi

Make sure Philhealth premium contributions are remitted with the correct amount on time with eezi’s simplified payroll system. Book a demo now to learn more!