Learn about your SSS monthly contribution, contribution rate, how to compute the amount, and what benefits its membership offers.

Key Points

- The contribution rate of employed members for 2024 is 14%. Of this rate, 9.5% is paid by the employer, and the remaining 4.5% is deducted from the employee’s pay.

- This rate is multiplied by the employee’s monthly salary credit (MSC).

- Self-employed individuals, voluntary members, and non-working spouses have to contribute 13% of their declared monthly earnings.

- Household employers use the same rate and table as regular employers and employees, but the employer solely pays for the contribution if the income is below Php 5,000 monthly.

What is SSS?

SSS, or Social Security System, is a social security or social insurance provider founded on Republic Act No. 1161 (Social Security Act of 1954).

Furthermore, the amendments strengthened the SSS foundation until Republic Act No. 11199 was passed and approved. In addition, RA 11199 is also called the Social Security Act of 2018.

Additionally, the government instituted SSS to provide financial assistance and support to its members (or their dependents) in times of sickness, disability, maternity, old age, calamities, unemployment, or death.

For example, financial assistance may come in the form of a salary loan, pension, or cash allowance. Furthermore, an SSS membership is a lifetime membership and paid contributions are non-withdrawable.

Looking for a different employee benefit? Check our list of government-mandated benefits.

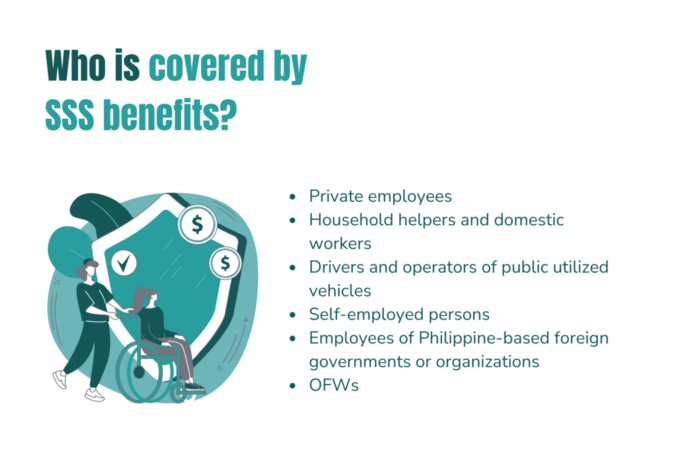

Who are the people required to be covered by the SSS?

RA 11199 also specifies the people that the Social Security System covers. Below is the list of said people.

Private employees

Employees of private companies and businesses, regardless of their employment status (provisional, temporary, permanent), are required by law to have active SSS accounts and make their SSS monthly contributions unless they are over the age of 60 years.

Household helpers and domestic workers

SSS also requires the people hired to do household chores and housework to have coverage. This policy applies as long as they are not over 60.

Drivers and operators of public-utilized vehicles

Operators and drivers of public utilized vehicles such as tricycles, jeepneys, vans, and buses must also have SSS coverage.

Self-employed persons

People who recognize no other employer but themselves, earn at least ₱ 1,000.00 per month, and are not over 60 years old are required by law to have SSS coverage. SSS also specifies who is classified as self-employed members.

- Self-employed professionals.

- Sole owners or partner proprietors of businesses.

- Media personalities, scriptwriters, directors, and news correspondents who are not employees.

- Professional athletes, trainers, and coaches.

- Farmers, fishermen, and workers from the Informal Sector (IS) who have irregular or seasonal incomes.

- Other self-employed individuals as categorized by the Social Security Commission (SSC).

Employees of Philippine-based foreign governments or organizations

The employees of foreign governments or organizations based here in the Philippines who have an administrative agreement with SSS must have SSS coverage.

Overseas Filipino Workers (OFWs)

All OFWs are now covered mandatorily by SSS, whether land-based or sea-based. OFW is defined as a person who will take part, is taking part, and has taken part in a paid activity in a location where they are not a citizen or aboard a vessel in foreign areas aside from government military or non-commercial ships.

Persons not belonging to the abovementioned groups can still register for an account with SSS. They will be under the Voluntary Member category.

eezi HR Guide

Stay updated with SSS, PhilHealth, Pag-IBIG, and BIR processes.

What is the SSS contribution rate in 2022?

2022 Contribution Rates and Tables

The monthly SSS contribution in 2022 was 13%. Furthermore, the employer and employees share the payment of this total contribution amount. The breakdown is as follows:

Empoyer Share: 0.085 or 8.5%

Employee Share: 0.045 or 4.5%

What is the new SSS contribution table starting 2023?

The monthly contributions to the SSS Fund recently increased to 14% in 2023 from 13% last year. As a result, there have also been adjustments to the contribution table. Furthermore, the breakdown of the employer and employee share is as follows:

Employer Share: 0.095 or 9.5%

Employee Share: 0.045 or 4.5%

Below is the contribution table:

The SSS contribution table, otherwise known as the SSS contribution schedule, shows the correct amounts of SSS contributions from the employer and the employee or any SSS member to make the total SSS monthly contribution. Computing the employer’s share, the employee’s share and the total contribution using the Monthly Salary Credit or MSC also requires the SSS contribution table.

The contributions may also include an Employee’s Compensation (EC) contribution for Employed members. The employer pays such solely as part of the Employee Compensation Program (ECP). Part of it provides a compensation package for work-related injury, sickness, or death.

The new SSS contribution table also has a column for the Mandatory Provident Fund (MPF). The MPF contribution is mandatory for those earning more than ₱20,250. The employer and the employee share the contribution for the MPF the same way they share the regular sss contribution, but only over ₱20,000. The MPF is a program to raise members’ savings for better retirement benefits.

Minimum monthly salary credit

As of 2024, the minimum monthly salary credit or MSC for SSS contributions is Php 4,000.00.

Maximum monthly salary credit

The maximum monthly salary credit, on the other hand, is Php 20,000.00.

What is the SSS contribution rate for 2024?

For 2024, the SSS contribution rate is still 14%, as with the previous year. As such, the 2023 SSS contribution table is applicable for 2024 calculations. Moreover, the employer and employee share is as follows:

eezi HR Guide

Stay updated with SSS, PhilHealth, Pag-IBIG, and BIR processes.

How to compute the SSS contributions of members

The total contribution rate for SSS premiums is 14% of the SSS member’s Monthly Salary Credit (MSC). You can find the MSC on the contribution table after determining the member’s correct Range of Compensation or salary bracket. To select the proper Range of Compensation, match where your monthly salary coincides. However, there are differences in computing the total contribution.

Regular employers and employees

The total monthly contribution (TMC) with a salary bracket below ₱20,250.00 can be computed using this formula:

(MSC x contribution rate) + EC contribution = TMC

2022 Computation

If your salary is ₱10,650.00, your MSC is ₱10,500, and your EC is 10. (10,500 x 0.13) + 10 = 1,375. Your Total Monthly Contribution is ₱1,375.00.

2023-2024 Computation: If your salary is ₱10,650.00, your MSC is ₱10,500, and your EC is 10. (10,500 x 0.14) + 10 = 1,480. Your Total Monthly Contribution is ₱1,480.

The total monthly contribution with a Range of Compensation equal to or above ₱20,250.00 can be computed using this formula:

(MSC x contribution rate) + EC contribution+ (MPF x contribution rate) = TMC

2022 Computation

If your salary is ₱23,000.00, your MSC is 20,000. Your MPF is 3,000, and your E.C. is 30. (20,000 x 0.13) + 30 + (3,000 x 0.13) = 3,020.00. Your total monthly contribution is ₱3,020.00.

2023-2024 Computation: If your salary is ₱23,000.00, your MSC is 20,000. Your MPF is 3,000, and your E.C. is 30. (20,000 x 0.14) + 30 + (3,000 x 0.14) = 3,020.00. Your total monthly contribution is ₱3,220.00.

Furthermore, you may use the formulas above to determine your share of the total SSS contribution. Just change the contribution rate from 0.14 to 0.095 if you are an employer, or remove E.C. and change the rate to 0.045 if you are an employee.

More examples:

- MSC at 11,500 and EC contribution at 10. (11,500 x 0.095) + 10 = 1,102.50. Your SSS monthly contribution for your employee is ₱1,102.50.

- MSC of 20,000, MPF of 4,500, and EC contribution of 30. (20,000 x 0.095) + 30 + (4,500 x 0.095) = 2,357.50. Your SSS monthly contribution for your employee is ₱2,357.50.

- MSC at 9,000. (9,000 x 0.045) = 405.00. Your SSS contribution is ₱405.00 per month.

- MSC of 20,000 and MPF of 3,500. (20,000 x 0.045) + (3,500 x 0.045) = 1,057.50. Your SSS contribution is ₱1,057.50 per month.

The employees’ total contribution comes from a monthly deduction from their salaries.

Self-employed member

Self-employed individuals must pay their total contribution, which is 13% of their declared monthly earnings, by themselves.

- For members with a range of compensation less than ₱20,250: (Monthly Salary Credit x rate of contribution) + EC = TMC. Example: (12,000 x 0.13) + 10 = 1,570. The TMC is ₱1,570.00.

- For members with a range of compensation equal to or over ₱20,250: (Monthly Salary Credit x rate of contribution) + (MPF x rate of contribution) + EC = TMC. Example: (20,000 x 0.13) + (2,000 x 0.13) + 30 = 2,890. The TMC is ₱2,890.00.

Voluntary members and non-working spouses

For a voluntary member, the range of compensation and monthly salary credit depends on the monthly income declared at the account registration.

- For members with a range of compensation less than ₱20,250: MSC x contribution rate = TMC. Example: 12,000 x 0.13 = 1,560. The TMC is ₱1,560.00.

- For members with a range of compensation equal to or over ₱20,250: (MSC x contribution rate) + (MPF x contribution rate) = TMC

Example: (20,000 x 0.13) + (2,000 x 0.13) = 2,860. The TMC is ₱2,860.00.

A non-working Spouse member is also a voluntary member and, therefore, uses the same formula to compute their total contribution as other members. The only difference is that their monthly salary credit is based on 50% of their working spouse’s MSC.

Household employers and kasambahays

Furthermore, the formulas used for the computation of the TMC for kasambahays and their employers are the same formulas used for Regular Employers and Employees. However, the TMC of a Kasambahay whose monthly income falls below ₱5,000 is paid solely by their household employer.

OFWs

Lastly, the formula for computing the TMC of an Overseas Filipino Worker is the same as that of voluntary individuals. The only difference is that the minimum MSC of an Overseas Filipino Worker is ₱8,000. This is higher than the ₱3,000 for voluntary individuals, regardless of their monthly income being less than ₱8,000.

eezi HR Guide

Stay compliant with the required employee benefits in the Philippines.

What are the benefits of SSS?

SSS provides several benefits for its members or their declared dependents. Mainly, SSS provides a total of the lucky number seven (7) benefits. Listed below are the benefits that SSS offers and their corresponding conditions.

Sickness benefit

The sickness benefit is a cash allowance given daily for the corresponding days of the member’s inability to work due to injury or sickness.

Qualification for sickness benefits:

- A member can avail of this benefit if they have been confined in a hospital or home for a minimum of four (4) days.

- They have used up all paid company sick leaves and have notified their employer

- They must have SSS contributions for three (3) months in the 12 months before the sickness or injury

- The member must notify SSS directly if they are not a regular employee

Sickness benefits:

- 90% of the member’s average daily salary credit (ADSC)

- The sickness benefit only covers a maximum of 120 days yearly

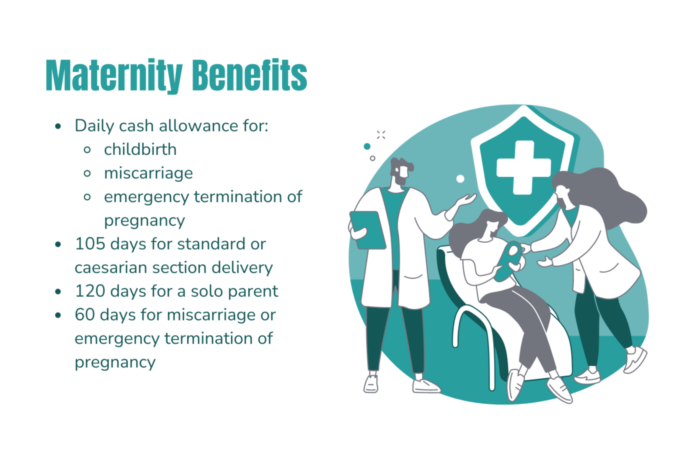

Maternity benefit

The maternity benefit is a cash allowance given daily for the number of days the member cannot work due to childbirth, miscarriage, or emergency termination of pregnancy.

Requirements for maternity leave benefits:

- The member must have complete payments for at least three (3) months of the 12 months before the semester of childbirth, miscarriage, or emergency termination of pregnancy.

- The member, if employed, must have notified her employer of her pregnancy and probable date of birth or informed SSS directly if not a regular employee.

Maternity leave:

- The member receives an amount equal to 100% of her ADSC for 105 days for standard or caesarian section delivery.

- 120 days of leave for a solo parent

- 60 days for miscarriage or emergency termination of pregnancy

Disability benefit

The disability benefit is a cash benefit given as a pension monthly, called Disability Pension, or as a lump sum amount to a member who has become completely or partially disabled permanently.

Qualification for disability benefits:

- At least 36 months’ worth of contributions

- The member has paid at least one month of monthly contribution before the semester of the disability

Note: If the contribution is less than 36 months, the member receives a lump sum instead.

Disability pension:

- Less than 10 credited years of service (CYS) = ₱2,000/month

- At least 10 years = ₱2,200

- More than 20 years = ₱3,400

In addition, ₱500 is given for Supplemental Allowance monthly.

Finally, a maximum of five (5) dependents of members with total disabilities are given a monthly pension amounting to 10% of the member’s basic monthly pension or ₱250, whichever is bigger.

Members with full total disability receive a 13th-month pension every December. Members with partial disability receive a 13th-month pension if the duration of the pension is at least 12 months.

Unemployment benefit

The unemployment benefit is a one-time payment cash benefit given to members who have been involuntarily separated from work due to downsizing, closure, installation of labor-saving devices, redundancy, and others. Separation from employment due to the member’s misconduct disqualifies him/her from this benefit.

Qualification for unemployment benefits

- The member must not be over 60 years old

- They have paid at least 36 months’ worth of contributions (12 must be within the 18-month period before the separation from work)

Unemployment benefits:

The amount a qualified member receives should be the amount of the member’s average monthly salary credit (AMSC). Moreover, they must claim this by filing within a year from the date of involuntary separation.

Retirement benefit

The retirement benefit is a cash benefit given to members as a monthly pension or a lump sum when they can no longer work due to old age.

Qualifications for retirement benefits:

- A member must at least be 60 years of age if separated from employment or at least 65 years of age if employed, self-employed, OFW, or Kasambahay.

- The member must have paid at least a total contribution worth 120 months

- If less than 120 months, the member is given the lump sum amount of his/her contributions.

Note: The member may opt to continue paying the contributions until they become eligible for the monthly SSS pension. Members are also given a 13th-month pension every December.

Retirement benefits:

- Qualified members get a minimum amount of ₱2,200 monthly pension if they have contributed for at least 10 years

- Members get a minimum of ₱3,400 for at least 20 years of contribution

- Members can elect a maximum of five (5) dependents who can receive a Dependent’s Pension equal to 10% of the member’s basic monthly pension or ₱250 at a minimum.

Death benefit

The death benefit is a cash benefit that is granted to the beneficiaries of a deceased member in the form of a monthly pension or lump sum amount.

Qualifications for death benefits:

- The member must have paid a total of 36 months’ worth of contribution for the primary beneficiary to qualify for a monthly pension

- Otherwise, they will receive a lump sum amount

Death benefits:

- The beneficiaries and dependents receive a monthly pension that is the same amount as that of the disability benefit

- The monthly pension is 90% of the member’s average daily salary credit (ADSC)

- In addition, they receive an additional 13th-month death pension is also given every December.

Funeral benefit

The funeral benefit is a cash benefit given to whoever paid for the funeral expenses of the deceased member.

Qualification for funeral benefits:

- The deceased must have made at least one (1) monthly contribution payment.

Funeral benefits:

- Claimants of deceased the member with at least 36 months of contribution get an amount between ₱20,000 and ₱60,000

Do not have an SSS account? In that case, you can first visit the SSS website (www.sss.gov.ph) online and apply for an account. For their website, click here. To apply for an SSS online account, register here.

SSS payment schedule

- Private Employers or Employees: Every month, remitted by employers

- Household Employers: Every month or every quarter, remitted by the household employer

- OFWs: Every month, every quarter, or every year

- Self-employed, voluntary, and non-working spouse members: Every month or every quarter, remitted by the registered member

How to check my SSS contribution

You may check your SSS contributions online, either through the official SSS website or the application.

- SSS Website: Log in using your SSS username and password and go to the contributions section.

- SSS Mobile App: Log in using your registered SSS username and password. The app’s home page shows the number of contributions posted, and tapping the tab shows all the dates and amounts.

Can I pay my SSS contributions online?

Yes. With the help of many digital payment platforms, remitting SSS contributions online is now easier. All you have to do is check your amount due for the month based on the SSS contribution tables and choose the most convenient mode of payment for you. You may either pay through your bank or through digital wallets.

Related:

Stay compliant with eezi

Stay up to date with eezi. Our system can help your payroll stay compliant, configurable, and user-friendly. Lastly, learn how to configure our payroll software for SSS contributions.