Here’s a Philippine payroll sample and formula for the calculation to guide your payroll processing.

Before you can become an employer in the Philippines, you must first get familiar with the ins and outs of doing business in the country. One such important aspect is payroll. Small businesses and large enterprises alike have payroll requirements to fulfill.

That said, a foolproof payroll needs a consultation with accountants and lawyers. But to give you an idea of the items that you have to take care of, below are the steps you have to go through:

How do I make payroll in the Philippines?

To set up your payroll in the Philippines, you would generally have to go through these steps:

- Registration with the Bureau of Internal Revenue (BIR) and applying for a Tax Identification Number (TIN) for your business.

- Record and manage employee information, including their TIN numbers, PhilHealth numbers from the Philippine Health Insurance Corporation (PHIC), Pag-IBIG, and Social Security System (SSS) numbers.

- Calculate payroll payments for each employee, indicating the gross pay, deductions, and net pay.

- Also, part of payroll processing is withholding and remitting income tax dues, government-mandated contributions, and submitting other government forms to the respective agencies.

- Next, payroll entails issuing pay slips or payroll summary reports to employees.

- Lastly, managing payroll requires keeping accurate records of all transactions. This is also for government compliance and adherence to labor laws and internal accounting purposes.

eezi HR Guide

Implement a new HRIS system like a pro!

Philippine payroll sample: What are the common items in a monthly payroll template?

Here are the common individual employee details that are usually included when calculating your employees’ salaries.

Basic salary

This is the fixed amount of compensation that your employee receives on a pay period. This amount does not include other benefits, bonuses, to allowances.

Overtime pay

Sometimes, work would require an employee to work beyond eight hours. As such, any additional hours worked beyond the regular working hours warrant overtime pay.

Holiday pay

Employees who report to work during holidays receive additional pay on top of their daily rates. See the rules here.

Minimum wage

There are varying minimum wages across industries and regions in the Philippines that serve as the baseline pay for employees.

Allowances

Aside from the basic pay, an employee may also have allowances. These are non-taxable amounts that the employees receive for purposes like transportation, meal, or connectivity allowances.

Deductions

The payroll process also includes computing deductions from an employee’s monthly salary as mandated by the government. Examples of these include the following:

- Withholding tax

Philippine employees earning more than Php 250,000 are required to pay taxes. As an employer, it is your obligation to withhold part of the employee’s salary and pay it directly to the Bureau of Internal Revenue (BIR) and fulfill the employee’s tax obligation.

- SSS contributions

Employees in private organizations in the Philippines are required to sign up with Social Security System (SSS) and pay the monthly dues. SSS contributions are divided between the employer and the employee. Furthermore, members of SSS are entitled to retirement, disability, and death benefits.

- PhilHealth contributions

Like SSS, employers also need to enroll their employees in PhilHealth and remit their contributions. The total amount for PhilHealth contributions is shouldered by both the employer and the employee.

- Pag-IBIG contributions

Employees in the Philippines also have to be enrolled in the Home Development Mutual Fund (HDMF or Pag-IBIG) for housing loans and benefits. As with SSS and PhilHealth, both the employer and the employee pay the total monthly contribution.

- Tax refund

There are cases where an employee pays more taxes than what they owe. In this case, it is an over-withholding, and a tax refund is given to the employee. Tax refunds are sent back in the form of checks, direct deposits, or debit cards.

- 13th-month pay

The 13th-month pay is a mandatory benefit for employees in the Philippines that is equivalent to 1/12 of the employee’s basic salary for the year. One reason behind this is to help employees financially during crucial times of the year. Furthermore, the law requires employers to release the 13th-month pay on or before December 24 each year.

eezi HR Guide

Stay updated with SSS, PhilHealth, Pag-IBIG, and BIR processes.

How do HR practitioners calculate payroll?

HR practitioners can calculate payroll in two ways: manually and by automation. With manual payroll calculation, an HR practitioner goes over each employee’s payroll data and makes the calculations individually.

Even with the help of an Excel sheet, doing manual computations on a bi-monthly basis while adhering to government regulations is a lot of work. Furthermore, it still does not guarantee accuracy. Automated payroll solves all of these problems.

Cloud-based HR and payroll software, for example, stores all the information that your company needs in one system and processes payroll for you. This includes timekeeping data, pays, deductions, taxes, and other payment amounts.

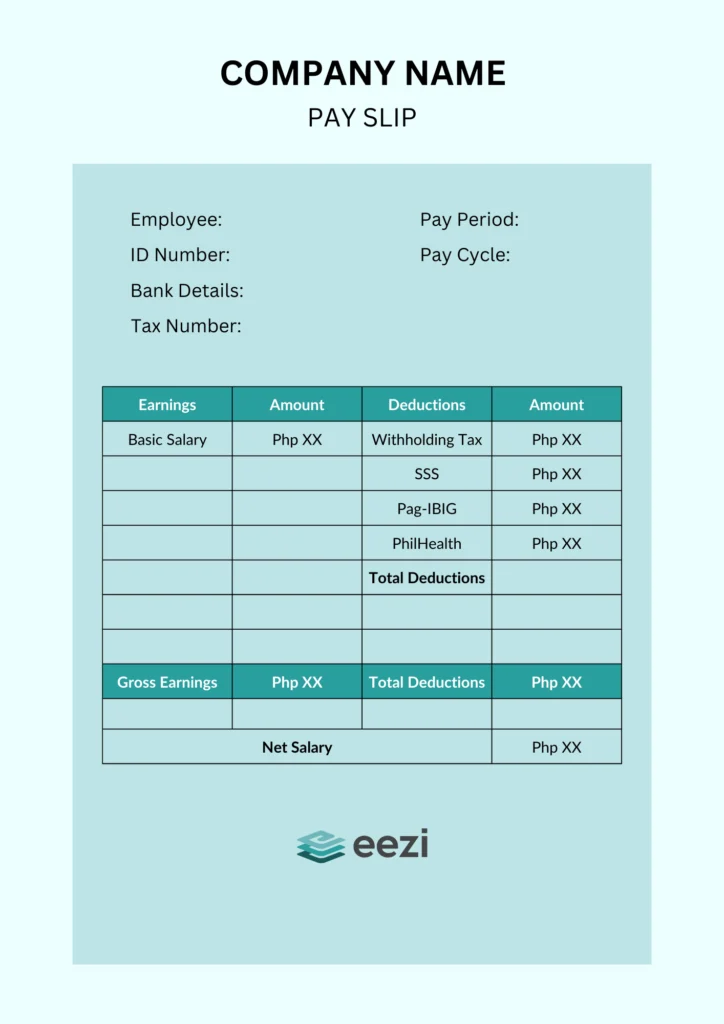

Philippine payroll sample: What are the contents of salary slips?

The above image is one payroll payslip sample Philippines. A typical salary slip payslip format would contain the following information:

- Employee details such as name, ID number, department, designation, and Tax Identification Number (TIN)

- Company name, address, and sometimes a logo

- The pay date or period. It can also reflect in the salary statement period.

- Gross pay, which is the total earnings before any deductions

- Deductions from contributions to government-mandated benefits, taxes, loans, and any other deductions specified in the employee’s contract.

- The net pay indicates the amount that the employee takes home after all the deductions from their gross pay.

- Overtime and incentives as part of the earnings

- Signature line for the employee and company representative

However, the contents of a pay slip may vary across different companies. Furthermore, the salary slip format may vary per organization. You may also check out free employee payslip sample template generators that you may use as a reference for your own pay slip.

What is the formula for payroll?

Calculating payroll generally follows these steps:

- Gross pay calculation: Total all the amount earned by an employee during the period, including basic pay, overtime pay, bonuses, and other compensation.

- Mandatory deductions calculation: Subtract the total of the deductions from the gross pay.

- Calculation of other deductions: Subtract health insurance payments, loan payments, or other retirement plan contributions from the gross pay.

- Net pay calculation: To get the net pay, subtract all the deductions from the total gross pay.

In short, the formula for net pay can be represented as:

Net Pay = Gross Pay – Mandatory Deductions – Other Deductions

Speed up your payroll preparation with eezi

Avoid payroll issues and calculate employee salaries fast and accurately each time with an automated payroll that fits your business needs. Learn how to onboard with us.