Learn all about withholding taxes, why they are deducted from salaries, what income is taxable, and why they are necessary.

The government is in charge of running and maintaining the whole country. Doing that and doing it right takes a lot of work and money. As such, it needs steady funding for all the necessary projects to maintain or improve the country and its services, like roads and building constructions.

One of the major sources of the government’s funding comes from the people’s taxes. Taxes come in several forms, one of which is withholding tax.

What is withholding tax?

Withholding tax is the compulsory amount employers deduct from an employee’s monthly salary that the employer then remits to the government. This deduction is the employees’ income tax liability. Moreover, employers have a legal obligation to report their employees’ income to the Bureau of Internal Revenue (BIR) and process the necessary withholding tax payments. Failure to fulfill these obligations can result in legal repercussions for employers.

But aside from employers, who else can withhold taxes?

Who withholds taxes?

Any authorized agent may withhold taxes. Withholding agents are the persons or entities in charge of deducting the correct amount from employees’ salaries. In addition, their task includes remitting the collected withholding taxes to BIR.

Examples of withholding agents in the Philippines

- Employers: Employers are required to withhold taxes from the salaries and compensation of their employees. This includes income tax on compensation, as well as contributions to the Social Security System (SSS), Philippine Health Insurance Corporation (PhilHealth), and Home Development Mutual Fund (Pag-IBIG).

- Banks and Financial Institutions: Banks and other financial institutions are withholding agents for creditable withholding taxes on interest income from deposits and other monetary benefits, including dividends and royalties.

- Businesses and Corporations: Companies are often required to withhold taxes on payments they make to suppliers, contractors, and professionals. This includes income tax on professional fees, value-added tax (VAT) on certain transactions, and expanded withholding tax on various payments.

- Government Agencies: Government agencies are withholding agents for taxes on certain payments made to suppliers, contractors, and individuals for services rendered. They are also responsible for withholding taxes on government employees’ compensation.

- Individuals or Professionals: Individuals and professionals who engage in businesses or freelance work may also be withholding agents. They may be required to withhold taxes on certain payments to their suppliers or service providers.

- Real Estate Brokers: Real estate brokers are withholding agents for capital gains tax on the sale of real properties.

- Withholding Agents in Special Cases: There are specific withholding agents for particular transactions, such as those involving income payments to non-resident aliens, winnings from horse racing, and more.

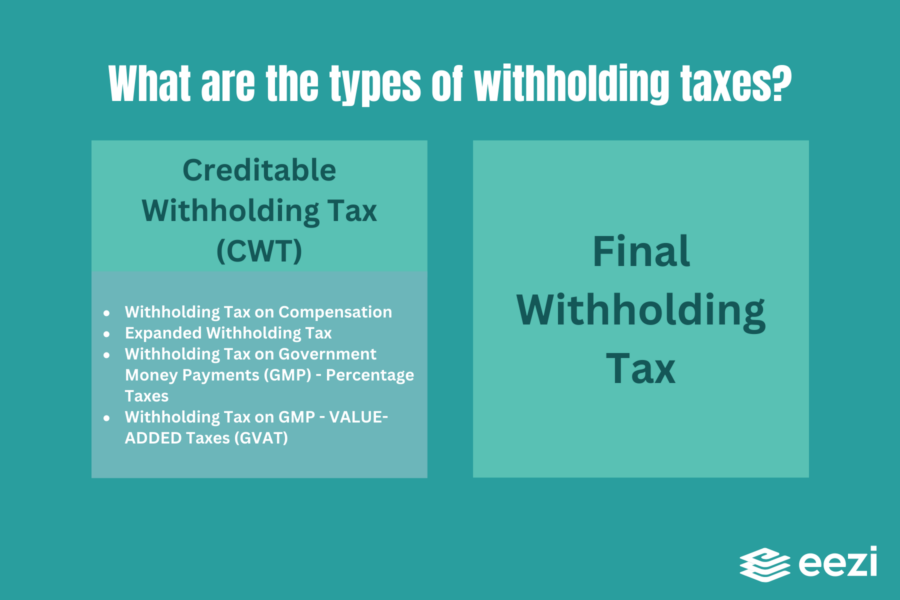

What are the types of withholding taxes?

Creditable Withholding Tax (CWT)

Creditable withholding tax is a type of withholding tax from the total tax that a taxpayer must remit to the Bureau of Internal Revenue (BIR) every year.

Withholding tax on compensation

Compensation is the amount employees receive as payment for services rendered in the form of salaries or wages. The withholding tax on compensation is the tax that comes strictly from the income of an employee from an employer-employee relationship.

Expanded withholding tax

The expanded withholding tax Philippines covers specific income payments. It is credited from the total income tax that the payer must remit to the BIR for the calendar year they earned the income.

Withholding tax on Government Money Payments (GMP) – Percentage Taxes

This type of withholding tax is withheld by NGAs and their instrumentalities. This includes GOCCs and LGUs. The NGAs withhold the tax before paying non-VAT registered taxpayers, suppliers, or payees.

Withholding tax on GMP – VALUE-ADDED Taxes (GVAT)

This tax is withheld by NGAs and their instrumentalities, including GOCCs and LGUs. Such deductions are also paid before VAT-registered taxpayers, suppliers, or payees due to their purchases of products and services.

Final Withholding Tax

The final tax meaning applies to specific income payments. Furthermore, this deduction cannot come from the other income tax due of the payee on other revenues in the applicable year. Lastly, an income that has been subjected to final tax cannot be further subjected to income taxes or capital gains tax.

What are the exemptions to withholding tax?

The law mandates the imposition of withholding taxes. However, the same law allows for several exemptions on where to apply the withholding tax. The following list shows the exemptions that BIR acknowledges:

- Payment received as an incident of employment as provisioned under R.A. 7641

- Payment for agricultural labor

- Payment for domestic services

- Payment for casual labor done outside the course of the employer’s business or trade

- Compensation for services conducted by a Filipino citizen for an international organization or foreign government

- Payment for damages, whether actual, moral, exemplary, or nominal

- Life insurance

- Returns of premiums

- Compensations for sickness or injuries

- Earnings exempted under a treaty

- 13th-month pay and other benefits

- Employee’s share on GSIS/SSS, Medicare, HDMF, PHIC, and others

- Revenue coming from wages of Minimum Wage Earners (MWEs) working in the private sector and receiving the Statutory Minimum Wage (SMW) as assigned by the Regional Tripartite Wage and Productivity Board (RTWPB) or the National Wages Productivity Commission (NWPC) having control over the place the employee is assigned

- Income from the compensation of employees working in the public sector and receiving no more than the SMW in the non-agricultural sector as assigned by the RTWPB/NWPC having control over the place the employee is assigned

- De Minimis benefits (See the de minimis rules in the Philippines)

- Fringe benefits given to employees that are not rank and file and subjected to Fringe Benefit Tax (FBT)

- Personnel Economic Relief Allowance (PERA) received by government employees and

- Representation and transportation allowance (RATA) is given to officers and employees in the public sector under the General Appropriations Act.

How to compute withholding tax on compensation?

The correct calculation of taxes is vital, especially during challenging economic times. There are a few steps to determine the correct withholding tax amount.

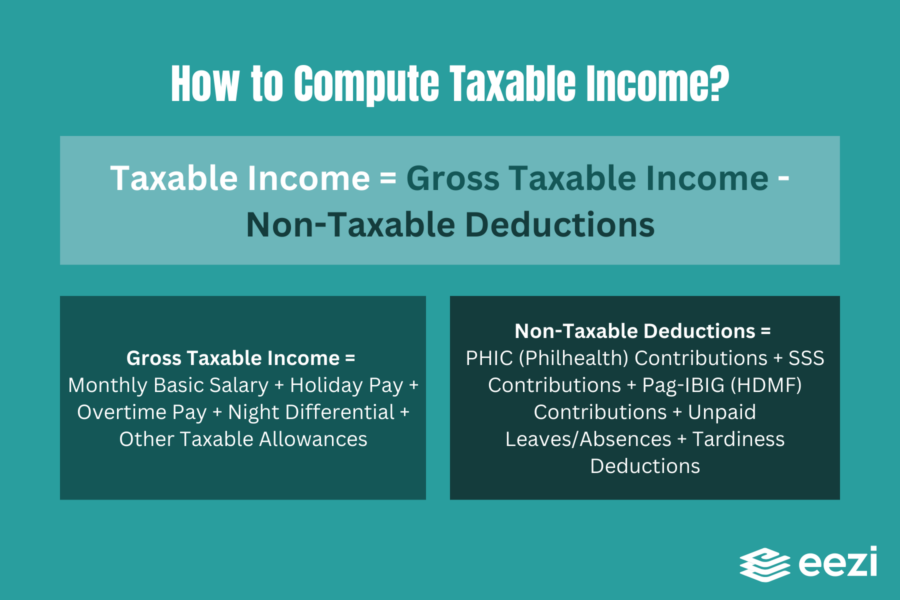

Computing the withholding tax as it appears in the employee’s BIR Form 2316 starts with the taxable income. The taxable income is the remaining balance after subtracting the non-taxable deductions from the gross taxable income.

Formula to compute monthly withholding tax

Taxable Income = Gross Taxable Income – Non-Taxable Deductions

Gross Taxable Income = Monthly Basic Salary + Holiday Pay + Overtime Pay + Night Differential + Other Taxable Allowances

Non-Taxable Deductions = PHIC (Philhealth) Contributions + SSS Contributions + Pag-IBIG (HDMF) Contributions + Unpaid Leaves/Absences + Tardiness Deductions

Sample Case

Once you have the amount for the taxable income, you can now check the appropriate withholding tax using the BIR’s withholding tax table (see below). To better illustrate this, let us have an example.

Example:

An employee named Lisa has a monthly basic salary of Php 18,000. She has earned Php 1,650 as holiday pay and Php 2,080 as overtime pay. Furthermore, Lisa paid a total of Php 1,020 for her SSS, Pag-IBIG, and Philhealth. She has no night differentials earned, other taxable allowances, unpaid leaves or absences, and tardiness deductions.

Sample Computation

We can use the above data in computing Lisa’s withholding tax on compensation as follows:

Lisa’s Taxable Income = (Php 18,000 + Php 1,650 + Php 2,080) – Php 1,020. We can further simplify it to Php 21,730 – Php 1,020, and we get Php 20,710 as Lisa’s taxable income. Using BIR’s withholding tax table for 2022 on a monthly basis, we determine that Lisa’s prescribed withholding tax on compensation amounts to zero.

Conclusion

Lisa’s withholding tax on compensation amounting to zero is due to the provisions of the Tax Reform for Acceleration and Inclusion (TRAIN) Law. Before the TRAIN law, the government required taxpayers to pay taxes at a 5% to 32% rate, depending on their bracket. Details like civil status and the number of dependents also factor in calculating the withholding tax on compensation.

With the Train Law in effect, those with annual taxable income of less than Php 250,000 are exempt from paying income tax. Thus, their compensation does not have deductions. The TRAIN law also lowered the rates of those who still need to pay income tax to 15% to 20%.

Old Withholding Tax Table for 2022

In accordance with the TRAIN law, BIR released a table for the revised withholding tax on a daily, weekly, semi-monthly, monthly, and annual basis, reflecting the changes in the applicable withholding taxes.

Withholding Tax Table for 2023-2024

The provisions of TRAIN law extend beyond December 31, 2022. BIR also released the following tables to serve as a reference for withholding tax computation at the start of 2023.

Simplify withholding tax calculations

Never miss a deadline and make tax calculations easier with eezi‘s automated payroll system. Learn how you can make your company more tax-compliant.